When contractors have extra liquidity or cash in their business, they have several strategic options to consider. The right choice will depend on their specific financial goals and the overall financial health of their business.

Over the past 15 years, I continue to see successful contractors keep all of their cash in their business and not “pull” the cash out and invest outside of the company.

Don’t get me wrong, I am not suggesting that you should not reinvest the profits back into your business. Reinvesting the profits towards debt reduction, capital improvements that make you more efficient, marketing & branding, training, and hiring a A-player are all good strategies.

However, even when these tactics are taken and you now are more profitable, leaving the excess cash in the business is NOT a recommended plan.

Why is Investing Outside Your Business Important?

Diversification: Relying solely on your business for wealth can be risky. Diversifying your investments outside of your business spreads your risk and reduces the impact of economic downturns or industry-specific challenges. It ensures that your financial well-being is not solely tied to the success of your business.

Risk management: Businesses inherently come with various risks, such as market fluctuations, competition, and operational challenges. By building wealth outside your business, you create a safety net to protect your financial future in case your business encounters difficulties or fails.

Financial security: Wealth outside your business can provide financial security for you and your family. It can be used for retirement planning, emergencies, and other long-term financial goals. It helps you maintain your standard of living and cover unexpected expenses without depleting your business assets.

Tax planning: Diversifying your wealth can be tax-efficient. Different investment vehicles and strategies may have varying tax implications. By spreading your wealth across different assets and accounts, you can take advantage of tax-advantaged options and minimize your tax liabilities.

Retirement planning: Accumulating wealth outside your business is critical for retirement planning. It allows you to create a retirement fund that doesn’t rely on the continued success of your business, giving you the freedom to retire when you choose.

What to focus on?

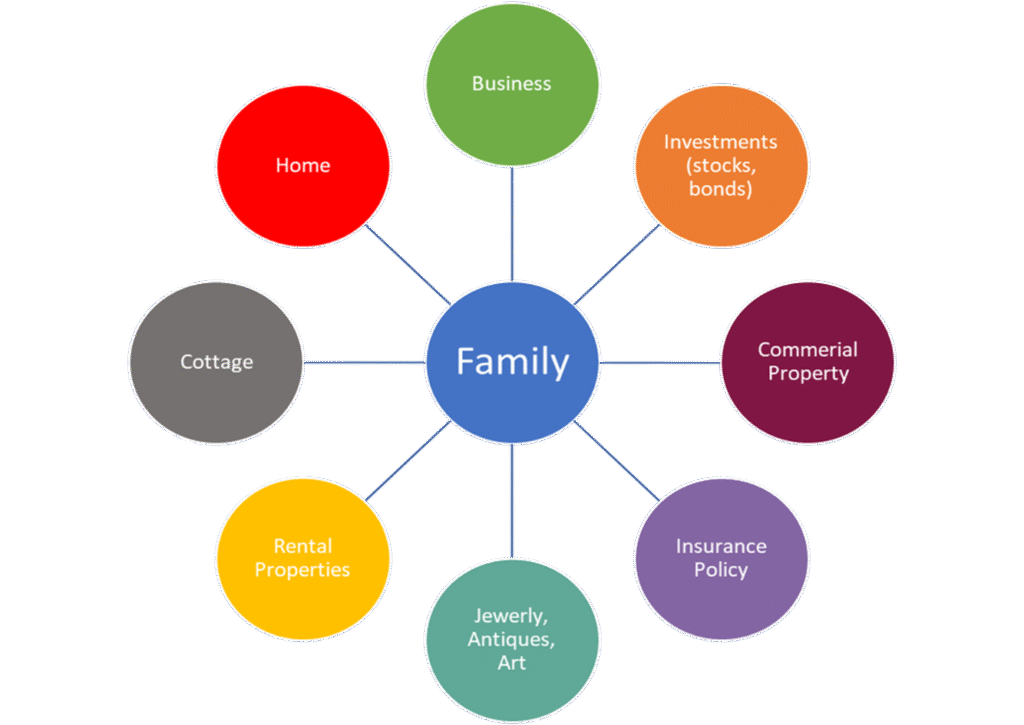

This diagram shows that there are many different options that will grow in value outside of your Operating Business.

Depending upon your tax situation, you may decide to invest personally or via a HoldCo. Additionally, you may require your investment to provide a dividend/income or you may not need the investment income today and want to continually reinvest it.

Here are some Investment Strategies that I have used:

Investment Strategies:

- Residential Mortgage (personal) – to pay down your personal mortgage for your family home, you could pay yourself dividends throughout the year and double up on your residential mortgage.

- Real Estate – Create a Hold Co. Transfer excess profits from the Operating Company to the HoldCo, and the HoldCo would hold the commercial/residential Real Estate

- Investments (REIT, Funds) – Invest in other Wealth Management Companies that hold Apartment REITs, Industrial or Retail REITs.

At the end of the day, my goal is for the investments OUTSIDE of my operating business continue to grow in value and produce its own dividend income so that I am not solely reliant on the Operating Business.

If you are ready to improve your company’s profit so that you can invest elsewhere, book your discovery call with me.

Happy Investing,

Nathan